Business pain points

The digital transformation of the industry requires RPA to implement technology leadership and improve operational efficiency

Business development needs, and the degree of automation of daily management in the industry needs to be improved. In recent years, many banks have started to pilot RPA, and the degree of digitalization has increased

Business Highlights:

Since May 2020, Shanghai Rural Commercial Bank has cooperated with i-Saiqi to launch the RPA project, and has launched automated processes in different departments, which has achieved remarkable results. With the development of business, it has successfully promoted the application of RPA throughout the bank, covering multiple business areas, realizing hundreds of efficient business scenarios, and promoting the high-quality development of rural commercial banks with RPA

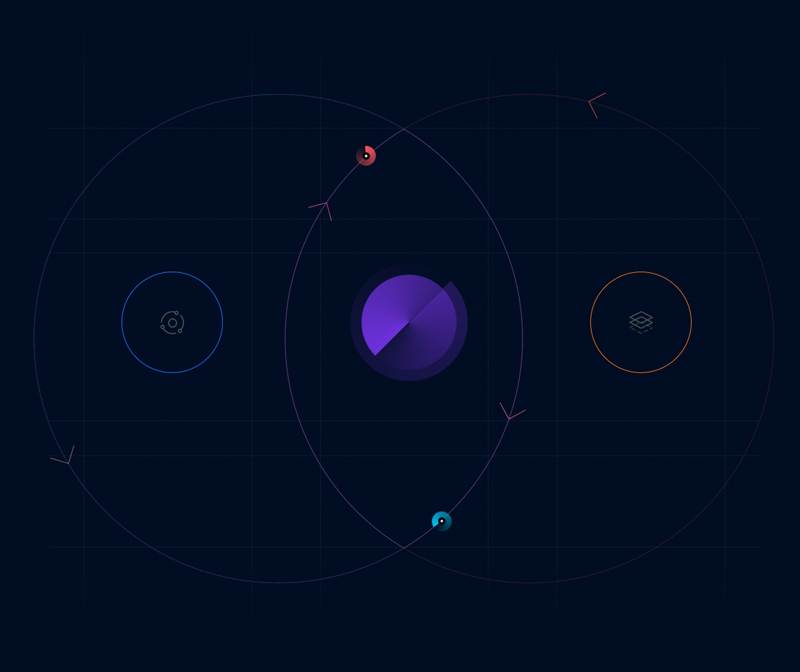

Solution

The integration of RPA and AI transforms IPA, boosts the online intelligence of the whole process of typical scenarios, and at the same time sinks to the grassroots level, reducing the burden on grassroots branches and related line personnel, and empowering the construction of the midfield.

Automation

Automation

Bank

Bank

Insurance

Insurance

Logistics

Logistics