Efficiency bottleneck

In terms of financial accounting and settlement, it is necessary to complete the monthly financial settlement of more than 300 enterprises every month, which is time-consuming and error prone to manual operation;

Compliance risk

In terms of risk management and compliance control, the energy industry is complicated in tax and capital related links, so it is difficult to find abnormalities in time through manual audit;

Data value idle

In terms of financial data analysis and decision support, massive financial data lacks intelligent analysis and is difficult to support accurate decision-making.On July 18, led by the Intelligent Finance Research Institute, the blue book on the application of digital intelligence technology industry finance integration, jointly prepared by Shanghai National Accounting Institute, i-Search and other institutions, was officially released.

This report took half a year to complete. It made a comprehensive analysis of the application of smart technology in the field of industry finance integration, covering technical concepts, typical features, technical architecture, application framework, typical cases and other contents, and attracted wide attention in the industry.

As one of the organizations participating in the compilation, i-Search actively contributed its practical experience and insight in the field of digital intelligence technology, helping the blue book comprehensively analyze the application of digital intelligence technology in the field of industry finance integration. Among them, the case of "digital intelligence technology empowers Shenneng group business services Co., Ltd. to integrate industry and finance" is very representative, which vividly shows how i-Search helps large group enterprises break through the bottleneck of transformation and achieve value improvement.

Shenneng commercial service

Integration of industry and Finance

Shenneng (Group) Co., Ltd. is a wholly state-owned enterprise group invested and supervised by Shanghai SASAC. Its business covers power, gas, securities and other fields, with more than 300 wholly-owned and holding enterprises. In january2020, in order to meet its own control mode and development needs, Shenneng group established a legal person sharing center - Shenneng group business services Co., Ltd. (hereinafter referred to as "Shenneng business services"), whose business covers the sharing of financial and human resources, and provides standardized, intensive, professional and intelligent sharing services for system enterprises.

With the development of business, the traditional financial management model faces three core challenges:

1.Efficiency bottleneck

1.Efficiency bottleneck

In terms of financial accounting and settlement, it is necessary to complete the monthly financial settlement of more than 300 enterprises every month, which is time-consuming and error prone to manual operation;

2.Compliance risk

In terms of risk management and compliance control, the energy industry is complicated in tax and capital related links, so it is difficult to find abnormalities in time through manual audit;

3.Data value idle

In terms of financial data analysis and decision support, massive financial data lacks intelligent analysis and is difficult to support accurate decision-making.

In this context, Shenneng business service has opened the road of digital intelligence transformation. During the "fourteenth five year plan" period, centering on the path of "standardization, digitalization and intelligence", it took finance as the core linkage business management, continued to deepen the construction of intelligent financial sharing system, and made remarkable achievements in the construction of intelligent tax platform and the integration and application of RPA, AI and Bi technologies.

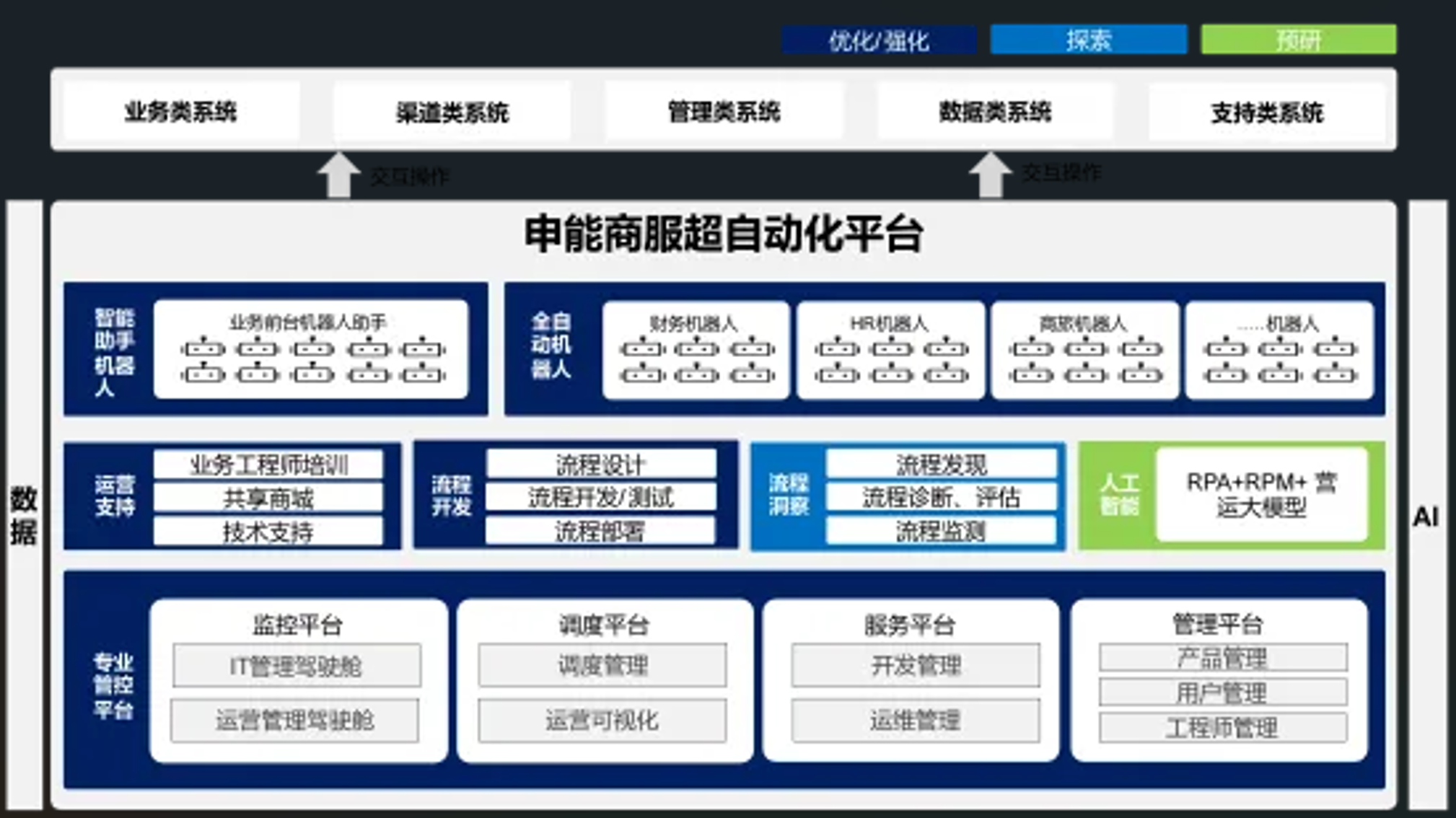

Based on the group's shared service system, Shenneng commercial service has prospectively planned to integrate RPA, process mining AI、 The super automation platform with large model and other technical capabilities drives the intelligent upgrading of the group's operation mode. The platform provides powerful automated process development and optimization capabilities, enabling business personnel to flexibly build, adjust and optimize automated processes and quickly adapt to business changes.In this context, Shenneng business service has opened the road of digital intelligence transformation. During the "fourteenth five year plan" period, centering on the path of "standardization, digitalization and intelligence", it took finance as the core linkage business management, continued to deepen the construction of intelligent financial sharing system, and made remarkable achievements in the construction of intelligent tax platform and the integration and application of RPA, AI and Bi technologies.

Enabled by digital intelligence technology

Practical cases

At the same time, Shenneng business service actively explores the combination of large model technology and financial agent, and promotes the transformation of financial management to a more accurate, efficient and intelligent direction. Financial agents can automatically process massive financial data, not only perform routine financial tasks, but also make intelligent predictions according to the data, providing support for fund scheduling, budgeting, etc. In order to better manage these agents, Shenneng commercial service is building an agent management platform of large model, which can be used for scheduling, monitoring and optimization through a unified framework and interface to ensure the efficient execution of agents in complex financial scenarios.

Three application scenarios

Practical changes brought about by digital intelligence technology

01

Monthly settlement automation

Let financial personnel say goodbye to "996"

Monthly financial settlement is the core link of financial management. More than 300 wholly-owned or holding enterprises of Shenneng group need to perform monthly settlement every month, involving general ledger accounting, internal reconciliation and other processes.

Solution:

RPA robot regularly monitors the mail receipt, automatically collects attachments and processes the table in the log;

Automatically identify the business unit type, perform monthly settlement, and complete user-defined transfer, account balance query, and report export;

Application effect:

The work that used to take many people a long time can now be completed at the beginning of the month or even at the end of the month, which not only replaces manual repeated operations, but also improves the timeliness of data processing, so that financial personnel can focus on more valuable analysis work.

02

Intelligent patrol inspection

7 × 24-hour financial "sentry"

The purpose of Financial Shared micro Service Patrol inspection is to ensure the stable operation of the financial system, ensure the accuracy of data, timely identify potential risks and optimize multiple links. Manual patrol inspection is difficult to fully cover problems such as payment exceptions and voucher errors, and the response is delayed.

Solution:

Regularly scan the system to automatically identify such abnormalities as delayed documents, uneven loans and payment failures, generate statistical reports and pre-warning, and timely notify the business personnel for review.

Application effect:

It realized 100% full coverage patrol inspection, effectively reduced the pressure on financial personnel in key periods such as monthly and annual settlement, and provided a strong guarantee for the smooth operation of financial processes.

03

Input tax check

Reject "manual account" and realize "one click completion"

In the process of financial sharing business, input tax is checked frequently and repeatedly. Financial personnel need to connect with the financial system and invoice management platform. Manual operation is prone to data omission, wrong check and other problems due to negligence.

Solution:

Automatically log in to the financial accounting system and the financial sharing system, retrieve and export data according to the preset conditions, batch process various invoice data, and then call the background script to sort out the data and generate the input tax check ledger.

Application effect:

Hundreds of tasks can be performed every day, and the work efficiency is improved by more than 80%. At the same time, various errors that may occur in manual operation are avoided, and the productivity of financial personnel is greatly released.

Digital intelligence technology is bringing profound changes to the integration of industry and finance of enterprises. The practice case of Shenneng business service provides a useful reference for the digital intelligence transformation of large group enterprises, and i-Search will continue to work in the field of digital intelligence technology to help more enterprises achieve transformation breakthroughs.

Digital intelligence technology is bringing profound changes to the integration of industry and finance of enterprises. The practice case of Shenneng business service provides a useful reference for the digital intelligence transformation of large group enterprises, and i-Search will continue to work in the field of digital intelligence technology to help more enterprises achieve transformation breakthroughs.

企业平台

企业平台 发现评估

发现评估 自动化

自动化 行业解决方案

行业解决方案 业务解决方案

业务解决方案 合作伙伴

合作伙伴 生态联盟

生态联盟 咨询服务

咨询服务 培训服务

培训服务 交流社区

交流社区 客户成功

客户成功 产品文档

产品文档

公司介绍

公司介绍 新闻列表

新闻列表 联系我们

联系我们 加入我们

加入我们